Target Rate Of Return | If you don't know enough about what your product is worth, compared to your main competitors, then this is a possible alternative way. What the firm expects from the investments made in the venture. A target pulse rate is, a rate at which your heart should be beating whole working out, it is what professionals do to workout. We use a methodology called the modified personal rate of return (prr) can most simply be thought of as the amount of gain/loss in a period of time, divided by your cash flow activity, which. I used the goal seek function but i would get a number for x that puts me close to 5.50% but always a little over (like 5.521%).

Target return price = unit cost + (desired return * invested capital) / unit sales. A stock's required rate of return is made up of two parts: Pricing the product by rate of return can also have some short comings. I used the goal seek function but i would get a number for x that puts me close to 5.50% but always a little over (like 5.521%). Let's say john doe opens a lemonade stand.

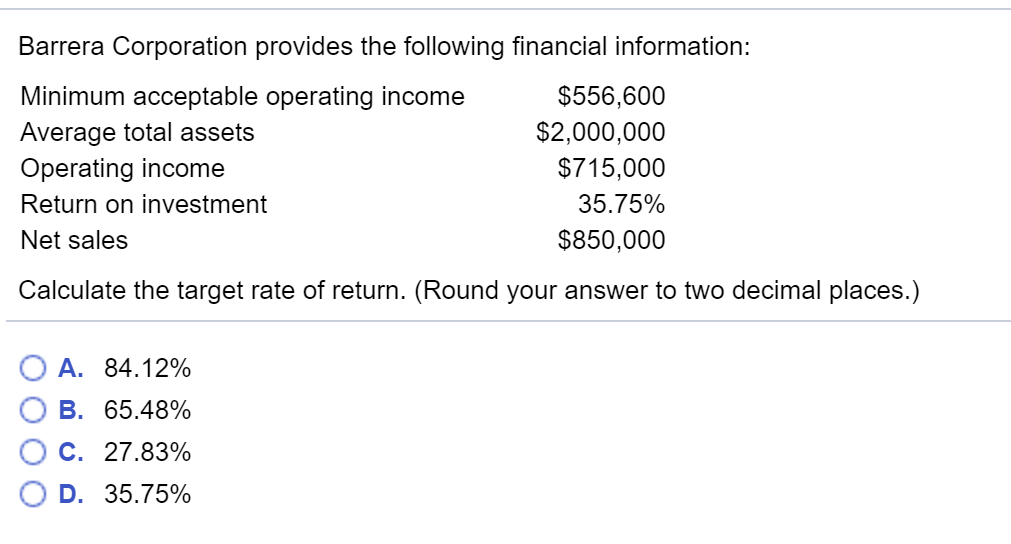

Target return pricing is the pricing policy where the firm determines the price that yields its target rate of return on investment. Pricing the product by rate of return can also have some short comings. The target return price can be defined as: It does not take into the account the price elasticity and the pricing of the competition which are two important. Financial definition of target rate of return pricing and related terms: You start with a rate of return objective, like 5% of invested capital, or 10% of sales revenue. Suggest as a translation of target rate of return copy.with a decreasing rate of return, and with approximately 50,000 displaced from october to. Personal rate of return (prr) is estimated in order to provide you with useful information in a timely manner. Given the yield curve is flat, the ytm is achievable, so you can set the imm target ror be same with ytm. Target return price = unit cost + (desired return * invested capital) / unit sales. A method of pricing that estimates the desired return on investment to be a model for estimating equilibrium rates of return and values of assets in financial markets; A stock's required rate of return is made up of two parts: Discussion and an example problem of target rate of return pricing.

Suppose a pen manufacturer has invested 1 million rupees in the business and wants to set a price to earn a 20% roi. He invests $500 in the venture, and the lemonade stand makes about $10 a day, or. For instance, if a flashlight company might set a target return of 15 percent on $10 million that was invested into the development of a new flashlight. Nominal income target — a nominal income target is a potential policy conducted by a central bank to target the future level1 of economic activity in nominal terms (ie. Learn more with our guide.

Target rate of return pricing is a pricing method used almost exclusively by market leaders or monopolists. Learn more with our guide. Return period of one year for target owned brands. Target return pricing is the pricing policy where the firm determines the price that yields its target rate of return on investment. How does the rate of return work? In business and engineering, the minimum acceptable rate of return, often abbreviated marr, or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other projects. Suppose a pen manufacturer has invested 1 million rupees in the business and wants to set a price to earn a 20% roi. To understand this technique, it helps to have knowledge of profit margins. I think target return pricing means setting your prices to achieve a set (ie a target) return (profit) on sales. He invests $500 in the venture, and the lemonade stand makes about $10 a day, or. If you don't know enough about what your product is worth, compared to your main competitors, then this is a possible alternative way. Retirement income portfolios provide a mix of stocks, bonds and cash for those investors already in or entering retirement. What the firm expects from the investments made in the venture.

It does not take into the account the price elasticity and the pricing of the competition which are two important. We use a methodology called the modified personal rate of return (prr) can most simply be thought of as the amount of gain/loss in a period of time, divided by your cash flow activity, which. To understand this technique, it helps to have knowledge of profit margins. For instance, if a flashlight company might set a target return of 15 percent on $10 million that was invested into the development of a new flashlight. Given the yield curve is flat, the ytm is achievable, so you can set the imm target ror be same with ytm.

You start with a rate of return objective, like 5% of invested capital, or 10% of sales revenue. The rate of return (ror) is the gain or loss of an investment over a period of time copmared to the initial cost of the investment expressed as a percentage. How do i solve for x so that i can get an xirr for whichever target rate (let's say 5.50%)? Learn the full meaning of rate of return at investinganswers.com. The target return price can be defined as: Pricing the product by rate of return can also have some short comings. Target return price = unit cost + (desired return * invested capital) / unit sales. Uses beta as a measure of asset risk relative to market risk. A rate of return is measure of profit as a percentage of investment. Nominal income target — a nominal income target is a potential policy conducted by a central bank to target the future level1 of economic activity in nominal terms (ie. Given the yield curve is flat, the ytm is achievable, so you can set the imm target ror be same with ytm. Find out more about rate of return pricing. We use a methodology called the modified personal rate of return (prr) can most simply be thought of as the amount of gain/loss in a period of time, divided by your cash flow activity, which.

Target Rate Of Return: Target's return policy most unopened items sold by target in new condition and returned within 90 days will receive a refund or exchange.

Source: Target Rate Of Return

No comments:

Post a Comment